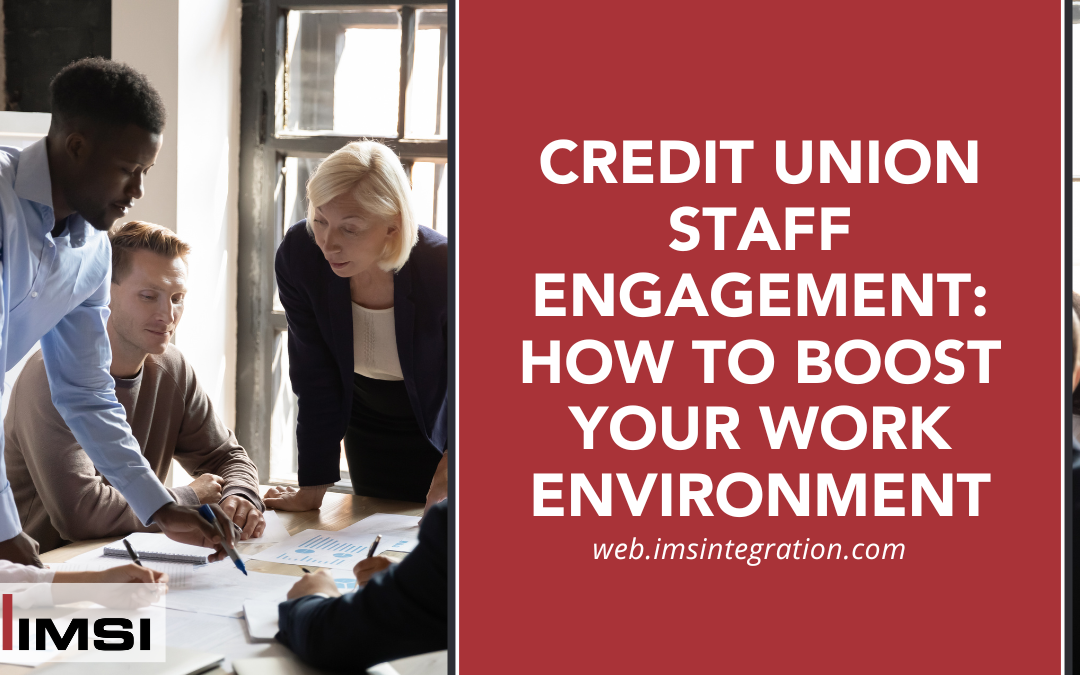

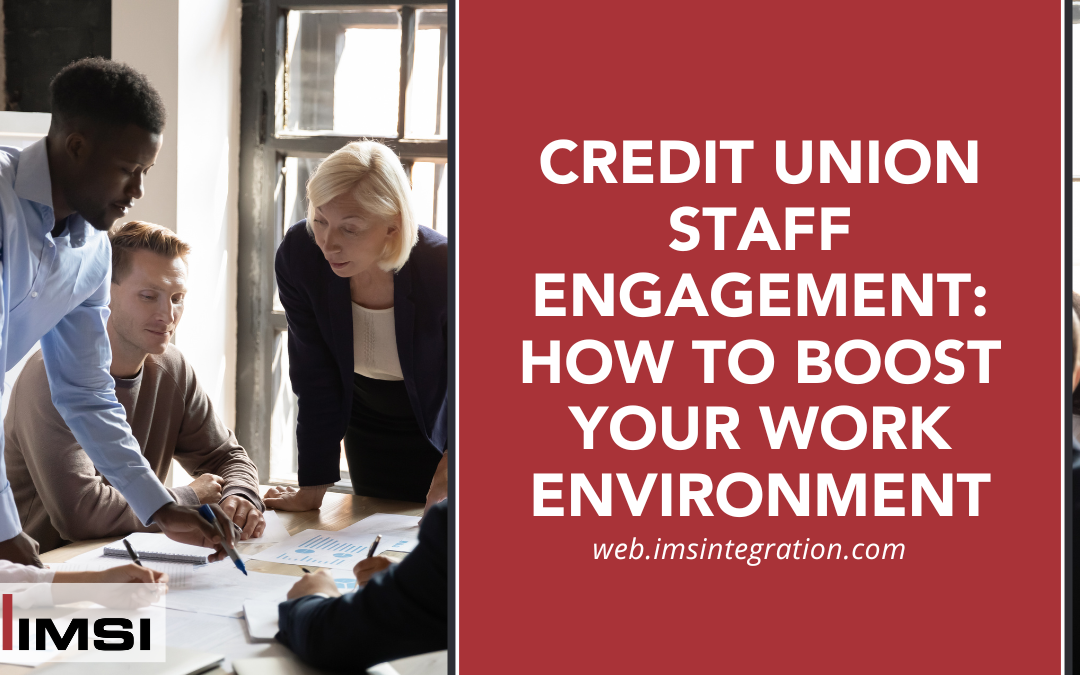

by Devon Wilson | Sep 19, 2022 | Credit Union Solutions

We recently talked about how the Great Resignation is affecting credit unions, and though we’ve seen a slowdown in the number of people quitting as we move further into 2022, most predictions show we’re in for some more hard days before things go back to any...

by Devon Wilson | Aug 8, 2022 | Credit Union Solutions

The Great Resignation has not been easy for credit unions. And much like the rest of the country, your credit union must be looking for some explanations and solutions to the problems caused by the Great Resignation. Your credit union staff is quite often part...

by Devon Wilson | Nov 22, 2021 | Credit Union Solutions

Like last year, 2021’s holiday season is going to present some unique challenges, many of which are – at least in part – caused by the coronavirus pandemic. Labor shortages and supply chain disruptions are going to make for some challenging interactions, and...

by Devon Wilson | Dec 21, 2020 | Member Service Representatives

As a credit union leader, you spend a lot of time working on ways to improve the member experience. But what about the employee experience? Your employees have taken on the brunt of the chaos of 2020 alongside you and your leadership team in an effort to...